Milwaukee County sales tax increase, Crowley signs into law

Milwaukee County sales tax increase, Crowley signs into law

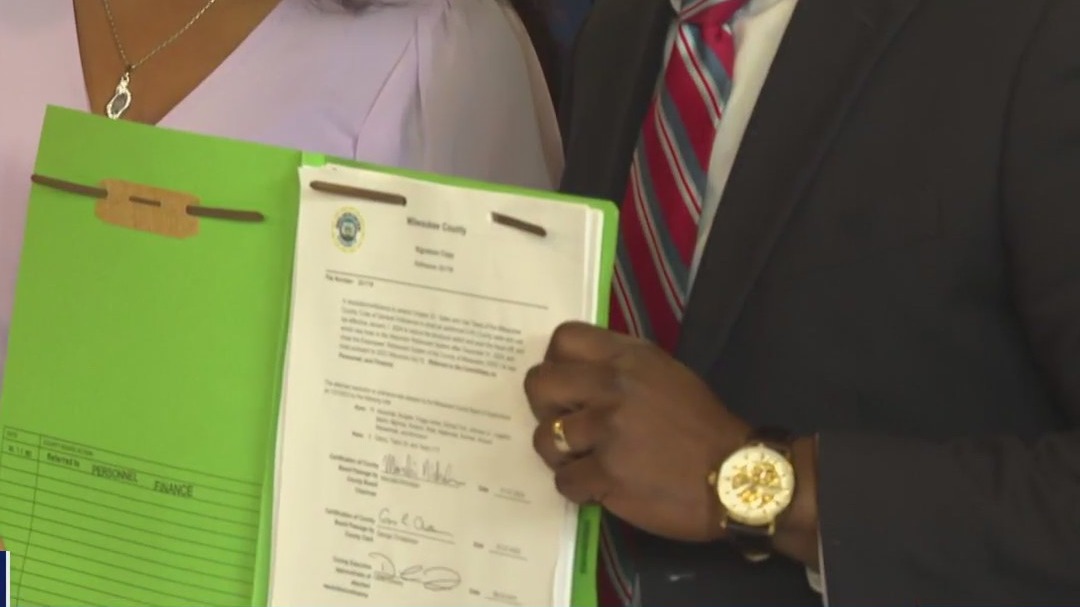

Milwaukee County Executive David Crowley signed the new 0.4% county sales tax increase into law Thursday at the Washington Park Senior Center.

MILWAUKEE - Milwaukee County Executive David Crowley signed the new 0.4% county sales tax increase into law Thursday at the Washington Park Senior Center.

The Milwaukee County Board of Supervisors voted July 27 to approve the sales tax increase. It was a 15-3 vote.

Right now in Milwaukee County, spenders pay a 5.5% sales tax on everything from cars to clothes to furniture – 5% goes to the state, and 0.5% goes to the county. In January, the city of Milwaukee will start a 2% sales tax as well.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

Milwaukee County tax increase signed into law

Now that county supervisors have approved the increase, that would be a total of 7.9% sales tax in the city of Milwaukee and 5.9% in the rest of Milwaukee County. Compared to Waukesha County, where there is no county sales tax, the same things over there would be taxed at 5%.

The Wisconsin Legislature and Gov. Tony Evers gave the power to the county to go behind the maximum other counties can charge. Supporters said, without it, the county would have to make massive cuts.

"This is going to allow us to invest in things like parks, in our transit system, in things like behavior health systems – to make sure we're putting our best foot forward as a community," Crowley said.

The added county sales tax would start in January 2024. It lasts for either 30 years or whenever the retirement system is fully funded, whichever comes first.

The state estimates the added tax would bring the county roughly $82 million per year. That must be used for the pension.

The state’s Act 12 also places strings on the county, one of which says, moving forward, two-thirds of the Milwaukee County Board of Supervisors will need to approve money for new programs or increased jobs.

RELATED: Find your Milwaukee County Supervisor

What is taxable?

- Clothing

- Computers

- Electricity

- Gas

- Water

- Admission to sports/entertainment events

- Parking for motor vehicles & aircraft

- Hotel rooms/lodging for under a month's stay

What is NOT taxable?

- Food/groceries intended for home consumption (if you dine/drink at a bar or restaurant, that's subject to sales tax)

- Bottled water

- Motor fuels (gasoline)

- Prescription drugs (excluding insulin)

- Insulin when used to treat diabetes/supplies for blood sugar testing

- Medical devices and equipment

How much will it cost you?

The Milwaukee County Budget Office estimated the average impact of the proposed added tax.

On average, those making less than $16,000 per year could see an added $46 in taxes. For those making $60,000 per year, they could see an estimated $148 per year in the new county tax. Those making roughly $221,000 could see an annual impact of $409. Finally, people with an annual salary of $983,000 could expect to spend an extra $1,095 per year, according to the budget office.

Official statements

Supervisor Peter Burgelis:

"We successfully amended the 0.4% sales tax resolution to ensure fiscal responsibility and address priorities our residents demand. We asked the public to contribute more to prevent the County’s insolvency. It is elected Supervisors’ duty to be accountable and prudently manage these valuable tax dollars. Our amendment makes the priorities of our constituents clear, and I look forward to a proposed budget from the County Executive that reflects those priorities."

Supervisor Patti Logsdon:

"As Supervisors, we are committed to upholding Milwaukee County residents' interests. Our intention is to ensure efficient tax management, with transparency and fiscal responsibility at the forefront. We pledge to adhere to our clearly outlined objectives and aim for strategic use of county reserves to lessen the tax levy and aid capital infrastructure needs approved by the Board," said Supervisor Logsdon. "We will remain watchful, scrutinizing every step of this initiative to ascertain that our commitments to the people of Milwaukee County are met."