Wisconsin budget: Evers signs, partially vetoes 2023-25 plan

Evers signs, partially vetoes budget

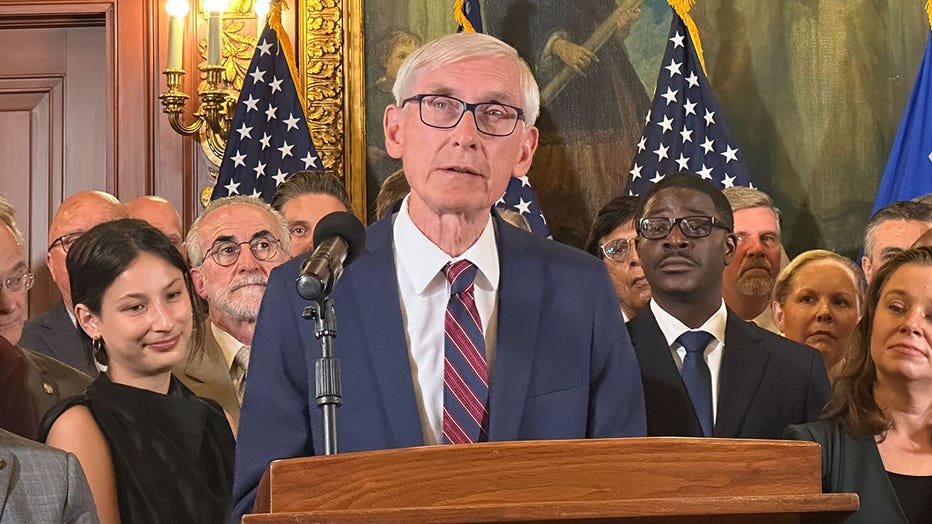

Wisconsin Gov. Tony Evers signed on Wednesday, July 5 the 2023-25 Biennial Budget at the State Capitol in Madison – but with partial vetoes.

MADISON, Wis. - Wisconsin Gov. Tony Evers signed on Wednesday, July 5 the 2023-25 Biennial Budget at the Capitol in Madison – but with partial vetoes. The governor called the Republican budget an "abdication" of duty.

"Even as I'm glad that the legislature joined me in making critical investments in several key areas, the fact remains that this budget remains imperfect and incomplete," Evers said before signing the budget. He called for subsides for child care providers, a big boost for the University of Wisconsin System, paid family leave, and legalization of marijuana.

Progressive groups, like the League of Woman Voters of Wisconsin, urged the governor to veto the budget – but he said he would not veto the entire budget, because it included things he wanted like funding for fighting PFAS, referred to as "forever chemicals" that have seeped into water. It also boosts money for tourism marketing, including money for Green Bay to host the 2025 NFL draft and money for VISIT Milwaukee to promote the city around the 2024 Republican National Convention. The budget also includes more than $1 billion dollars for public schools, boosts in shared revenue for local communities, and higher pay to help fill staffing shortages for correctional officers, prosecutors and public defenders.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

"Vetoeing this entire budget would mean abandoning priorities and ideas that I have spent four years advocating for," said Evers.

He instead used partial vetoes 51 times. One of those includes directing $15 million for grants to child care providers.

"That's a pittance. Our proposal in this budget, I think it was $300 million, so is $15 million a big, big number for me personally? Yeah, it's a big number, but to make sure that we have an early childhood system that works for everybody, that keeps people in the workforce that want to be in the workforce, that $15 million will not do it. Not even close."

Gov. Tony Evers

Another partial veto, created by striking out a few words and numbers, will allow school districts to add $325 per student every year through 2425. The original text, passed by Republicans, called for the increase in the 2023-24 and 2024-2025 school years. He cut out the hyphen and the "20" to create the year "2425" as the new end date of the $325 a year increase.

The governor also used a partial veto to keep 188 diversity, equity and inclusion jobs at the UW System. One thing that stays in this signed budget is Republicans' proposal to cut $32 million from the UW System, the same amount Republicans estimated the system would use for diversity equity and inclusion. That money can come back to the system if the school system uses it for workforce development.

The governor also partially vetoed Republicans' income tax cuts. They approved $3.5 billion, half of the state’s current budget surplus. Instead, Evers' income tax cuts will total $175 million. He's keeping Republicans' income tax cuts for the bottom two brackets, that's for individuals making up to $25,520 and up to $34,030 for married filers. Evers will not lower the other two brackets.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android

"Using my broad veto authority, I'm doing what I can to ensure that tax relief goes to working families who need help affording rising costs, not the wealthiest taxpayers in Wisconsin," he said.

With his changes, the governor’s signed budget now leaves another roughly $3 billion unspent. He said he's giving the Wisconsin Legislature a second chance and calls on them to use the remaining funds for child care, paid family leave, the UW System and education.

"Do I think that our University of Wisconsin System and our technical college system can survive well with no increase? Hell no," Evers said.

More on income tax cuts

One of the biggest questions in the budget debate was how Wisconsin should spend an expected $7 billion budget surplus. Republicans approved using roughly half of it on income tax cuts.

"If the government takes too much money, we think the public, the taxpayers, the hardworking taxpayers of this state, can spend this money better than what Madison bureaucrats can do," said State Rep. Terry Katsma (R-Oostburg).

Democrats said the GOP plan favored the rich and the surplus should go elsewhere – including subsidies for child care providers.

"Why? Why were those things not included? And the answer is pretty plainly before us: to afford a major tax cut for the wealthy in this state," said State Rep. Tip McGuire (D-Kenosha). "The 11 richest people in Wisconsin will each get $1.8 million in tax cuts under the Republican package."

"Creating problems for generations to come by cutting the tax rate for the richest to the degree where they are going to be seeing the largest benefit out of this, and those who are struggling the most will get a pittance," said State Sen. Chris Larson (D-Milwaukee).

"The goal is to try to keep successful people in Wisconsin no matter what their income is. We want people to move to Wisconsin," Vos said. "One of the things that’s always frustrated me is when people choose to retire, they take their success, and they move to another state."

Republicans approved $3.5 billion in income tax cuts that would have lowered rates for each tax bracket. The average cuts were going to be:

- For people making $25,000-$30,000 – $15

- For people making $60,0000-$70,000 – $250

- For people making $250,000-$350,000 – $2,157

Wisconsin 2023-25 Biennial Budget; Gov. Evers signs plan with partial vetoes

Wisconsin 2023-25 Biennial Budget; Gov. Evers signs plan with partial vetoes

For those with the lowest income, the current tax is 3.54%. It will go down to 3.5%. For those with middle income, there are two brackets: 4.65% and 5.3%. Under the Republican plan, the second of those two middle brackets would have been eliminated and the new, single middle bracket would have become 4.4%. Finally, those with the highest income have a current tax rate of 7.65%, which Republicans wanted to shift down to 6.5%

For comparison purposes, Illinois has a flat tax for income at 4.95% for all taxpayers, while Minnesota's tax rates go from 5.35% for the lowest earners up to 9.85% for the top earners.

"I know the other states that have that have trouble finding people, too. No, it's my belief that the middle class in the state of Wisconsin is where we should be supporting those cuts in the most efficient way possible," Evers told FOX6 News in response to criticism that having the state's highest tax bracket higher than most neighboring states, except Minnesota, would drive people to live in other states.

Republicans in the legislature will have the chance to try to overturn the governor's partial vetoes, but GOP leaders have not shared if they will host that vote.

Wisconsin Gov. Tony Evers fields questions about partial vetoes on biennial budget plan

Wisconsin Gov. Tony Evers fields questions about partial vetoes on biennial budget plan

Reaction

Assembly Speaker Robin Vos (R-Rochester):

"Legislative Republicans worked tirelessly over the last few months to block Governor Evers’ liberal tax and spending agenda. Unfortunately, because of his powerful veto authority, he reinstated some of it today.

"Vetoing tax cuts on the top two brackets provides hardly any tax relief for truly middle-class families. His decision also creates another economic disadvantage for Wisconsin, leaving our top bracket higher than most of our neighboring states, including Illinois.

"Wisconsin property taxpayers will also bear the burden of Gov. Evers veto regarding per-pupil school funding. By allowing this level into the future, homeowners will experience massive property tax increases in the coming years.

"I am disappointed with his decision to reinstate diversity, equity, and inclusion positions on our college campuses. Contrary to Governor Evers’ statements, Republicans are not waging a war AGAINST higher education. We are waging a war FOR higher education by signaling that well-balanced instruction and merit-based advancement should be the foundation of earning a degree.

"Additionally, the state’s Medicaid program should not be funding transgender surgeries and gender-affirming care. The Governor’s veto allowing this practice to continue takes money away from low-income families who truly need Medicaid dollars for important healthcare visits and procedures.

"Clearly, now that he’s won re-election by taking credit for Republican ideas, it’s business as usual for Governor Evers, as he returns to his true liberal ideology."

Senate Majority Leader Devin LeMahieu (R-Oostburg):

"The Governor had a chance to sign the largest tax cut in Wisconsin’s history and provide a tax cut for every taxpayer in the state. Instead, he chose to keep more than $2.7 billion in Madison rather than in the pockets of hardworking families.

"The Governor’s action today will raise taxes on individual income tax filers making more than $25,520 compared to the plan the legislature approved last week.

"States around the nation are cutting taxes and benefitting from the economic opportunity a competitive tax structure provides. Governor Evers’ partial veto risks allowing Wisconsin to fall behind our competitor states in the Midwest and nationally.

"The State Senate is committed to providing substantial tax relief to all Wisconsin taxpayers and making our tax structure flatter and fairer."

State Sen. Van Wanggaard (R-Racine):

"With his veto message today Governor Evers said, ‘F*** the taxpayers, they don’t know a G** d*** thing about spending their own money.’ These vetoes aren’t the work of a rational governor. They are the conscious decisions of a radical governor.

"Governor Evers decided that no taxpayer deserves more than $37 in tax relief. He decided that taxpayers should only get back 2.5 % of their record overpayment of taxes that created the $7 billion surplus. He thinks the other $6.8 billion is better spent by him, not you. And thanks to his decisions, your tax dollars will pay for sex-change operations.

"He unilaterally chose to set school funding for the next 402 years, no matter the impact on property taxpayers. And he decided that revolving loans aren’t good, he wants to be able to give away free money to those he deems fit.

"It would be funny if it wasn’t so serious."

State Sen. Dan Knodl (R-Germantown):

"For the third time now, our state’s Republican legislature and Democratic governor have been able to come together and craft a budget that cuts taxes and doesn’t squander our hard-earned surplus.

"While I am disappointed that the governor vetoed away $2.7 billion in income tax cuts while also triggering four centuries of automatic annual property tax increases, I am happy to report that a number of my proposals were included in the budget. These include much-needed funds for repairs to the Walter Schroeder Aquatic Center in Brown Deer, new investments in driver education for low-income youth, and the required funds to pay for the repeal of the personal property tax and ensure our local governments remain whole."

State Sen. Howard Marklein (R-Spring Green):

"The Republican legislature delivered a state budget that is made for Wisconsin, which is why the Governor signed our budget. I am frustrated, however, that he cut our $3.5 billion tax cut down to $175 million and it will only go to families making less than $36,840 per year. This is not a middle class tax cut.

"Instead, the Governor has decided that $2.7 billion should stay in Madison, rather than be sent back to you, the taxpayer.

"Regardless of the Governor’s misguided tax policies, I continue to be proud of our work on the state’s spending plans for the next two years. We gave the Governor a great plan that he couldn’t possibly veto. He adopted most of our work to craft a state budget that funds our priorities and plans for the future."

State Rep. Duey Stroebel (R-Cedarburg):

"After hearing from thousands of constituents across the state and taking their comments into consideration, the Joint Finance Committee crafted a budget that was made for Wisconsin. Once again, Governor Evers decided to apply a litany of line-item vetoes to the budget bill that was placed on his desk, with the biggest victims being the hardworking taxpayers of Wisconsin.

"With just a few strokes of his powerful veto pen, Evers gutted legislative Republicans’ $3.5 billion income tax cut and reduced it by 95%. Wisconsin’s middle-class families and small businesses across the state will no longer see meaningful tax relief. To add insult to injury, Evers’ used his Frankenstein veto authority to loosen property tax limitations for K-12 schools through year 2425, which will result in significant increases in the property tax bills of Wisconsin homeowners in the future.

"Governor Evers has turned a budget that provided historic relief to Wisconsin taxpayers into a budget that instead slaps them in the face by leaving billions of their hard-earned dollars in the state government’s coffers. These are the results of divided government with a Democrat as our governor."

State Superintendent Dr. Jill Underly:

"Any increase in spending authority for public schools is better than none, especially given that past budgets failed to provide that investment. I am thankful that elected leaders in Wisconsin have recognized the need to better support our public schools.

"This budget is a strong start, thanks in large part to Governor Evers’ veto. It offers districts an ongoing foundation of revenue growth to build from. But we continue to need answers to the growing shortages and inequities caused by a lack of mental health, nutrition, and special education funding, as well as the imbalances caused by publicly funding two education systems, and only one of which really serves all kids. I hope we can rectify that in future budgets.

"To reflect the value we should be placing on Wisconsin’s children and our collective future, we must robustly fund our public schools in a visionary way. I am hopeful this budget can be an initial step in that direction."

Waukesha County Executive Josh Schoemann:

"I am deeply disappointed that Governor Evers vetoed such a commonsense solution without more than a courtesy call from his staff a few minutes before it was announced, but I greatly appreciate the opportunity we had to work with our partners at UW System, UW-Milwaukee, Moraine Park Technical College, and the Wisconsin Technical College System to try and propose a solution that avoids another UW-Richland."

IRG Action Fund CEO CJ Szafir:

"The legislature's tax plan would have helped small businesses grow, assisting middle-class workers along the way. But instead of working with Republicans to make Wisconsin a better state for all, (Gov. Evers has) chosen to continue a tax system that punishes success.

"Wisconsin's punitive tax system forces families, small businesses, and entrepreneurs to leave the state. This is a real missed opportunity."

WHEDA CEO and Executive Director Elmer Moore Jr.:

"Today is a very special day for Wisconsin due to the extraordinary investment in affordable housing included in the 2023-25 Biennial Budget. We are excited to move forward with these efforts to help Wisconsin thrive by expanding access to affordable housing choices.

"I want to thank Governor Evers for his unwavering support of housing as a core human need as well as Representative Brooks, Senator Quinn, and the many authors of the Workforce Housing Package for spearheading bipartisan efforts to address our housing crisis. We stand ready to implement new programs that will enable more people in Wisconsin to have an affordable place to call home."

Wisconsin Manufacturers & Commerce (WMC) President & CEO Kurt Bauer:

"Instead of Wisconsinites getting $3.5 billion of their money back, Gov. Evers has all but eliminated any meaningful tax relief for middle-class families and small- and medium-sized businesses. This will hurt the state’s competitiveness for attracting and retaining both employers and a talented workforce.

"Hard-working middle-class families and employers who pay the individual income tax will be hurt most by Gov. Evers’ actions. With a nearly $7 billion surplus, it is unconscionable and embarrassing that Wisconsinites will not see substantial income tax reform.

"While other states are enacting these forward-thinking reforms, Wisconsin is stuck in neutral. Reducing and flattening the state income tax would have brought us more in line with neighboring states – almost all of whom have a flat income tax of less than five percent.

"Gov. Evers sent a message loud and clear to everyone in the state today. As long as he is in office, Wisconsin will continue to be a high-tax state for middle-class families and the businesses that are the backbone of our economy."

Wisconsin Farm Bureau Federation President Kevin Krentz:

"From big ticket items like the $150 million to fix farm roads, to more targeted initiatives like meat and dairy processor grants and funding for the state’s Ag in the Classroom program, this was a good budget for farmers.

"We greatly appreciate the support we’ve received from the state legislature and Gov. Evers throughout the budget process and look forward to continuing to work together to successfully implement these programs for Wisconsin farmers and rural families.

"This funding will go a long way in helping programs and initiatives that support what our members do every day – feed families in their communities, across the state and around the globe."