Delay in student loan forgiveness impacts Milwaukee woman

Delay in student loan forgiveness impacts Milwaukee woman

A woman said she qualified for student loan forgiveness, but her StudentAid.gov account did not accurately reflect her payment count.

MILWAUKEE - Student loans are the second-largest form of consumer debt after mortgages, according to the Education Data Initiative.

Many borrowers who work in public service count on forgiveness of their student loans. One Milwaukee woman said claiming her loan forgiveness was a challenge.

Building a career

What we know:

Alyssa Burrage has worked for the last decade in public schools, as a teacher and district leader. Burrage worked for schools in Washington D.C. and Denver, before arriving in West Allis four years ago.

Alyssa Burrage

Ten years in public service is a professional milestone and a financial one. Burrage said she took out federal loans for her undergraduate degree from Indiana University and for her graduate degree from Denver University.

"I've been working really hard to stay on top of my payments," said Burrage.

After 120 months of payments, Burrage should qualify for loan forgiveness through the Public Service Loan Forgiveness (PSLF) Program. She reached out Contact 6 because her account stopped correctly tracking her payments.

Alyssa Burrage

"The system has been incredibly difficult to navigate," Burrage told Contact 6.

The history

The backstory:

George W. Bush had bipartisan support when he signed and created the PSLF program in 2007. The intent behind the program is to keep college graduates in public service jobs, despite the lower salaries.

"You try to be patient but there's a lot of financial pressure on families right now," said Burrage.

Burrage has been tracking her loan payments at StudentAid.gov. She said despite making 122 payments, her payment account showed just 111 payments.

"I do think I am definitely not the only person in this situation," said Burrage.

An "unprecedented time"

What they're saying:

Carole Trone of the Wisconsin Coalition on Student Debt said it's been an unprecedented time for the Department of Education.

"She's not alone," said Trone.

FREE DOWNLOAD: Get breaking news alerts in the FOX LOCAL Mobile app for iOS or Android

Trone said the agency has been reacting to administrations with widely different policies about loan forgiveness, not to mention payment pauses, court challenges and layoffs.

"It's a confusing landscape," said Trone. "It's not going to get simpler anytime soon."

Carole Trone

Digging deeper

By the numbers:

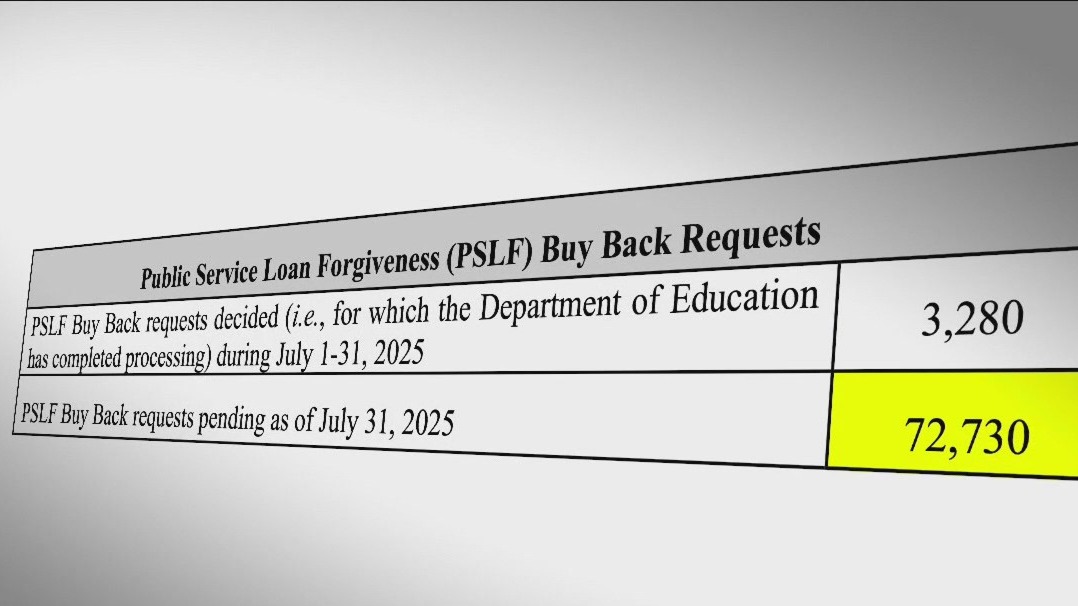

The average debt among public servants eligible for PSLF is about $88,000, according to the Education Data Initiative. Right now, there's a backlog of applications waiting for loan relief.

"This particular borrower, I want to point out, did exactly the right thing," said Trone. "In terms of really monitoring the payments she made."

Contact 6 steps in

What we know:

Contact 6 wrote to the U.S. Department of Education of Burrage's behalf. Burrage said two days later, her loan status updated.

"It said, 'Congratulations. You've now met your obligations for this loan,'" said Burrage. "I was honestly in disbelief when I saw that."

A U.S. Department of Education spokesperson confirms that Burrage's loans are officially forgiven. Burrage is also eligible for a refund of her additional payments beyond the 120 payments required.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

The spokesperson said since 2021, Federal Student Aid has been working to cut back on manual processing. It's also taking steps to modernize its loan program and improve its borrower dashboard.

About 3.5 million borrowers working in public service are eligible for loan forgiveness, according to the Education Data Initiative.

Lawmaker reaction

What they're saying:

Senator Ron Johnson's office did not respond to Contact 6's requests for comment on Burrage's loan forgiveness hold-up.

Senator Tammy Baldwin's office said her frequently does casework for constituents in the PSLF program. That casework involves updating payment accounts, securing overpayment refunds and loan forgiveness.

Baldwin's office said response times for their congressional inquiries have stretched to four to 11 months.

"Wisconsinites who are teaching and giving back to their communities were promised that they would get relief from their loans," said Baldwin. "Donald Trump should spend less time trying to shut down the Department of Education and more time doing right by our teachers and children."

About 31% of Americans say they oppose canceling student loan debt.

The Source: Information for this report comes from Alyssa Burrage, Carole Trone, the U.S. Department of Education and the Education Data Initiative.