Best Wisconsin Lottery odds: Claim your property tax relief

Best Wisconsin Lottery odds: Claim your property tax relief

Did you know there’s a way to get money from the Wisconsin Lottery without winning? You don’t even have to buy a ticket.

MILWAUKEE - Did you know there’s a way to get money from the Wisconsin Lottery without winning? You don’t even have to buy a ticket.

You don’t need to pick numbers, scratch cards or match any symbols to get the money.

In fact, if you own a home in Wisconsin, you’re likely entitled to a couple hundred dollars a year. That’s because every time a lottery ticket is sold in the state, a portion of that sale is set aside for homeowners.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

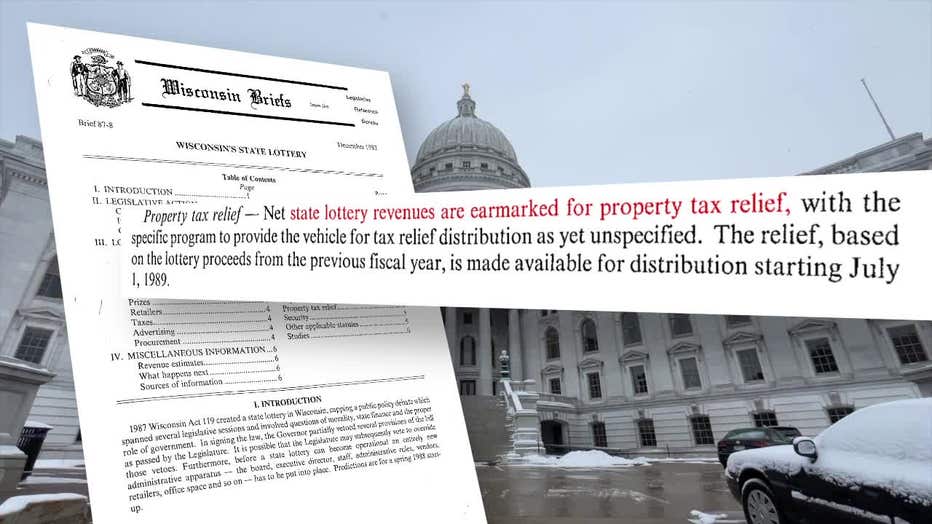

When Wisconsin legalized the lottery in 1987, part of that bill said proceeds had to help pay homeowner property taxes.

"The [credit] range for 2022 was from about $150 to about $300, depending on where you lived," said Teri Jacobson, Kenosha County treasurer. "It varies depending on your school district."

Wisconsin bill that legalized the lottery in 1987

However, Jacobson says homeowners don’t automatically get the credit. They have to apply first. You can check whether you’re getting the credit on your property tax bill. It’s listed as the Lottery and Gaming Credit.

"The best way [to find out] is to look at your property tax bill," said Jacobson. "If you have a number that’s bigger than zero, you’re getting the lottery credit."

If your property tax bill shows a blank space on the Lottery and Gaming Credit line, then you’re not getting the credit.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

If you own a Wisconsin property that’s also your primary residence, you likely qualify. You can find the application on the Department of Revenue’s website or at your county treasurer’s office.

In Kenosha County, you can check whether you’re receiving the credit online.

"We say every time someone wins [the lottery], every Wisconsinite benefits because it’s just more money that goes into this property tax credit," said Peter Barca, secretary of the Department of Revenue (DOR).

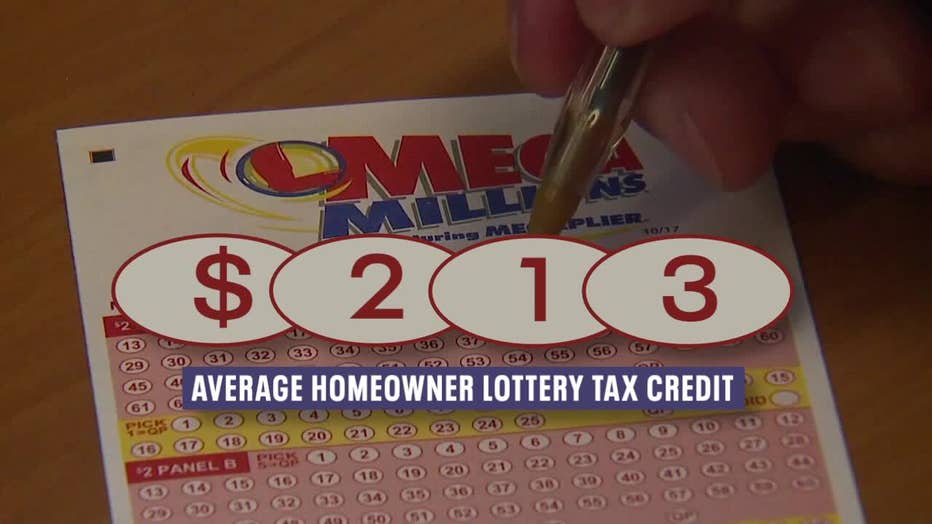

In 2022, the DOR reports $320 million went toward the Lottery and Gaming Credit in Wisconsin. The average homeowner received a credit of $213. In Milwaukee County, the average credit was $242.

"It goes up and down, depending on how much money the lottery is able to collect," said Barca.

Michael Reiter in Mukwonago wrote to Contact 6 after learning he’d stopped getting the credit in 2017. Reiter wanted to remind FOX6 viewers to check their property tax bills for the Lottery and Gaming Credit every year.

"If you’re entitled to it, you should get it," said Reiter.

As Reiter found out, some cases aren’t cut and dry as to whether the homeowner qualifies, like mobile homes or properties placed in a trust. Reiter has a Life Estate, which lists his three children on the title, as part of his estate planning. The Waukesha County treasurer initially said he didn’t qualify because his kids don’t live in his home.

"We’re just trying to make it easier for the kids and make it harder for us," said Reiter.

Reiter reapplied for the credit and was approved. In February, he received a late 2022 Lottery and Gaming Credit check for $182.

At the time he met Contact 6, Reiter hadn’t cashed the check yet because the Waukesha County treasurer initially said it was sent in error. After exchanging emails with the treasurer, Contact 6 was able to confirm that Reiter does qualify for the Lottery and Gaming Credit. Reiter will receive the credit on his tax bill going forward.

The Kenosha County treasurer says most of the time, determining a homeowner’s eligibility is simple.

"In 90, 95% of the cases, it’s pretty straightforward," said Jacobson. "You own your house, you live at your house, you’re due to have a lottery credit."

Wisconsin homeowners can still claim last year’s Lottery and Gaming credit by filling out an application by Oct. 1 here.

The DOR has a list of frequently asked questions about the Lottery and Gaming Credit online.