Scam victim must pay tax bills on lost money: Contact 6

Scam victim must pay tax bills on lost money

In 2023, a Whitefish Bay woman lost her entire savings to a complex and convincing scam. Then, she learned much of her lost money was taxable.

WHITEFISH BAY, Wis. - She was devastated by a scam then slapped with a tax bill. In 2023, a Whitefish Bay woman lost her entire savings to a complex and convincing scam. Then, she learned much of her lost money was taxable. That hasn’t always been how it works.

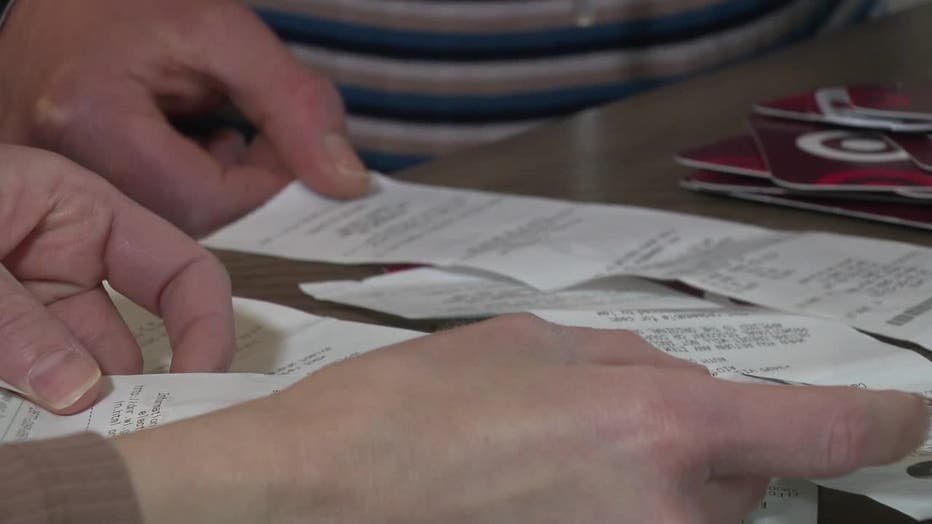

Sitting at her kitchen table, Kaitlin Henze sifted through a pile of receipts and gift cards. The cards represented only a fraction of the money that Henze lost to an elaborate scam.

"I purchased these with my credit card, so it’s credit card debt," said Henze.

Kaitlin Henze

Henze says the fraudsters falsified government documents, badges and bank deposit records to earn her trust. They claimed to work for Wells Fargo and the Federal Trade Commission and told Henze that her identity was stolen.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

"They led me through a series of steps to supposedly secure my money. In the process, they were actually stealing my money," said Henze.

Henze says she lost more than $200,000 to the scam. Much of the money from her 401k.

"I was nervous if I could pay my mortgage," said Henze of the fallout. "If I could just pay the normal bills I had to live."

Kaitlin Henze

Today, Henze is facing another financial blow in the form of two tax bills.

Henze owes the IRS about $15,000 and the state of Wisconsin around $7,500. The reason? Much of the money Henze withdrew from her 401k and investment accounts and sent to the scammers was taxable.

"You just got all of your money, your life savings, completely drained," said Henze. "Now, we’re going to hit you again."

Tax attorney Robert Teuber of von Brisen & Roper says the tax consequences come from the victim making a withdrawal from their retirement account. Prior to 2018, Teuber says a victim could take a theft loss deduction on their federal tax return.

Robert Teuber

Teuber says that itemized deduction went away with the Tax Cuts and Jobs Act of 2017.

"No matter how elaborate (the scam), there isn’t a loss deduction right now that would work for them," said Teuber.

Robert Teuber

Teuber says the state of Wisconsin doesn’t have a theft loss deduction either. He says scam victims can try challenging their tax balance with the IRS, but there are filing fees and no guarantees. In Wisconsin, victims can ask for a reduced tax liability, in some cases.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android

"If the crime that they’ve been subjected to has left them in some way destitute," said Teuber.

Despite losing her entire savings, Henze has managed to hold onto her house. She says that means her assets are "too much" to qualify,

"I’d just begun to get to the point where I didn’t need to be extremely nervous every day (about money)," said Henze.

Just as Henze starts to finally find her footing again, she says the tax bills are a big step back.

"I don’t have enough money to even pay a quarter of that right now," said Henze.

Kaitlin Henze

Henze says her plan is to tackle as much of her taxes as she can, then pay interest until she’s able to pay the bills in full.

Contact 6 asked Senator Tammy Baldwin and Senator Ron Johnson for comment on this story. Johnson’s office did not respond.

Baldwin told Contact 6 in the following statement:

"Our tax code should be making sure big corporations and the wealthy are paying their fair share, not punishing Wisconsinites who already have been ripped off by a scam or theft. What is happening with Kaitlin is wrong and I am writing legislation to make sure that people who have been scammed or are victims of fraud are not also slapped with a tax bill."