Property assessment mistake, Milwaukee math teacher finds $150K error

Property assessment mistake, Milwaukee math teacher finds $150K error

A Milwaukee math teacher caught a $150,000 mistake on his property assessment for 2023. Contact 6 reached out, and officials looked into the case.

MILWAUKEE - In a few weeks, the city of Milwaukee Assessor’s Office will mail out property assessments.

2023 is a maintenance year for city assessments. That means most values carry over from 2022, unless there’s been an error or change to the property.

One Milwaukee man wrote to Contact 6 to argue his 2022 home assessment was way too high.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

When it comes to numbers, high school math teacher Matthew Vang knows that outliers usually come from mistakes. So, when Vang’s home in a pretty uniform Milwaukee neighborhood was the only property to jump well above $500,000 after assessment, he ran his own calculations.

"I said to myself, ‘This doesn’t make sense,’" said Vang.

Matthew Vang explains situation to Contact 6's Jenna Sachs

Vang said he tried calling the Assessor’s Office.

"What you did here is not right," Vang recalled saying over the phone. "I’m asking the guy, ‘How did you calculate the assessment?’"

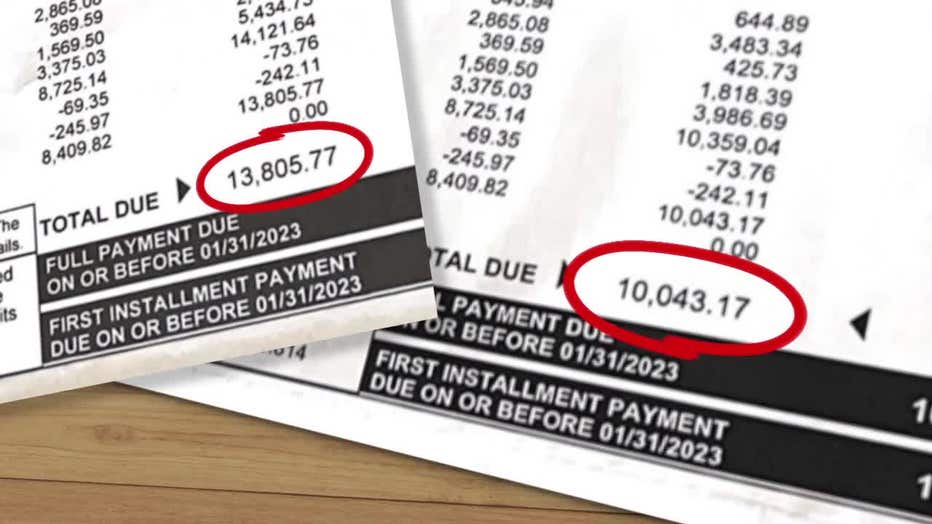

Unable to get a clear answer, Vang wrote to Contact 6. He pointed out his property taxes were rising from $8,400 a year to $13,800 a year. Vang said an increase that big didn’t make sense.

"It can’t be 65%," Vang told Contact 6, "and, it can’t be just my property."

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

Under Wisconsin law, homeowners can appeal their property assessment during what’s called "Open Book." Open Book is held in the spring in the weeks after assessment notices are mailed out. During this time, property owners can visit their local assessor’s office to review their assessed values and assessment rolls. If a Milwaukee homeowner feels their assessment is incorrect, they must file their objection form by May 15.

"If a bedroom count is wrong, if they feel like the square footage is off, talk to us," said Nicole Larsen, the city of Milwaukee's commissioner of assessments.

Larsen said home style, location, housing market and property age all factor into an assessment.

"When people say, ‘Oh, my assessment is so high!’ My question back is always, ‘Well, do you think you could sell your house for the value we have assessed it at?’" said Larsen.

Nicole Larsen, city of Milwaukee's commissioner of assessments

Vang does not think he can sell his home for its 2022 assessed value. That’s a red flag.

"That was a fairly simple one in the grand scheme of things," said Larsen, of Vang’s situation.

After Contact 6 sent Vang’s complaint form to the Assessor’s Office, Larsen looked into his case. She discovered Vang’s house was listed as a "Cape Cod" when similar homes in his neighborhood were styled as "colonials."

"Cape Cods are just a style of property that are higher in demand," explained Larsen. "Their square-foot price is higher than a colonial."

Matthew Vang's Milwaukee property assessment error discrepancy

Larsen changed the designation of Vang’s home to colonial. After this correction, Vang’s property assessment dropped from $593,000 to $435,000. His property taxes went down, too.

"From almost $14,000 to $10,000," Vang told Contact 6.

Larsen said many homeowners object to their assessment because they assume their tax bill will increase by the same percentage. That’s not actually the case. If the percentage increase is lower than the city’s average increase, the tax bill should not go up.

In Milwaukee, Open Book usually runs from mid-April until the third Monday in May. Appeals are reviewed by an internal board of assessors. If the property owners still disagree with the decision, they can ask for a second review by a citizen-appointed board.