Robin Vos wants 'significantly' more than $3 billion in tax cuts

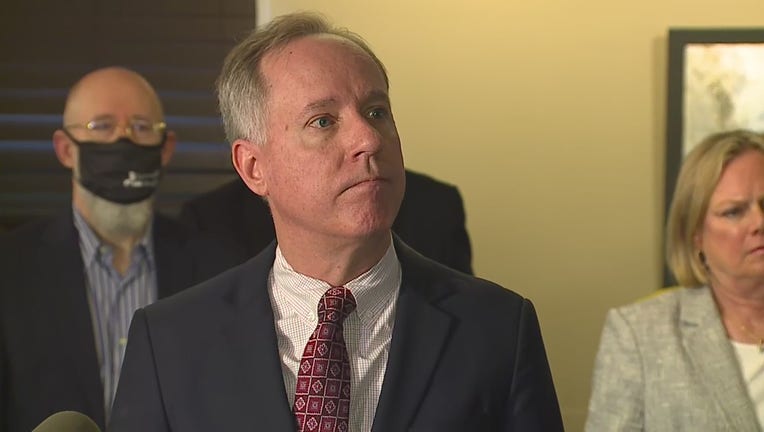

Assembly Speaker Robin Vos

MADISON, Wis. - Wisconsin Assembly Speaker Robin Vos said Friday he wants to cut taxes by "significantly" more than $3.4 billion in the next state budget, while remaining coy about how he wants to address major issues such as funding for schools and local governments.

Vos, along with Democratic state Rep. Kalan Haywood, discussed how they would like to see the Legislature handle the state's projected $6.6 billion budget surplus during a virtual event Friday hosted by the nonpartisan Wisconsin Policy Forum.

Vos and Republicans for months have said they want to cut taxes, with an emphases on further flattening the state's income tax rates. The last state budget, passed by the Legislature and signed by Gov. Tony Evers, cut taxes by $3.4 billion.

"I can’t see us doing a lower tax cut than we did last time," Vos said. He called $3.4 billion the "absolutely bare bones bottom" of what Republicans will cut.

"We think it would be significantly higher than that," he said.

Wisconsin’s income tax rates begin at 3.54% and increase to 7.65%. The top rate applies to single filers earning $280,950 and up; married joint filers making more than $374,600; and married people filing separate returns with taxable income of more than $187,300.

Vos said he wanted to lower taxes for those in the highest bracket, but all taxpayers will see cuts. Haywood said any tax cuts should favor the poor and middle class.

"They all deserve relief," Vos said. "I don’t think we can just keep focusing on the one bracket, it has to be all brackets."

Evers will release his budget proposal to the Legislature on Feb. 15. Over the next several months, the Republican-controlled Legislature will rewrite it before sending their two-year spending plan back to Evers likely in June. It will cover state spending from July 1 through June 30, 2025.

The surplus gives Evers and the Legislature a tremendous opportunity to address spending needs, cut taxes or save money. The fight will be over who gets how much.

Local governments are one group in discussion with lawmakers over increasing the money they get from the state, known as shared revenue. Vos said he was the early stages of discussing ideas with groups representing counties, cities, towns and villages.

One possibility they've discussed is using 1% of the state sales tax to replace shared revenue, with the idea that as sales taxes increases so too does funding for local governments, Vos said. Shared revenue for counties and municipalities dropped more than 6% in 2012 and has been flat ever since, leading to increased calls to create a different funding system.

"We are we are nowhere near what that would look like," Vos said of replacing shared revenue with a portion of the sales tax. "But that broad outline seems to be one that a lot of people are interested in."

Evers has called for increasing shared revenue by 4% in each of the next two years.

Before giving more funding to Milwaukee, however, Vos said he wanted to see what changes the city is willing to make to save money, like consolidating services or merging its retirement system with the state's.

"Revenue without reform is DOA," Vos said. "We’re not going to just say more revenue is the answer to the problem."

Vos said he was open to spending more on K-12 public schools, but in the past he has said that most be coupled with expansion of the school choice program.

"We have to see what’s realistic versus what’s possible," he said in reference to school funding.

When asked about Madison exploring the possibility of seeking an Amtrak train connecting the capital city to Milwaukee, Vos said he would oppose any state money going toward the project.