New rules on paying for college

New rules on paying for college

Paying for college is a challenge even in the best of economic times. So when more challenging times came with the pandemic, as they did for millions of Americans, affording a degree became significantly harder. But Consumer Reports explains that recent changes could make school more affordable.

Paying for college is a challenge even in the best of economic times.

So when more challenging times came with the pandemic, as they did for millions of Americans, affording a degree became significantly harder.

But Consumer Reports explains that recent changes could make school more affordable.

This unprecedented time has also been a catalyst for significant changes that could make higher education more affordable and student debt easier to manage.

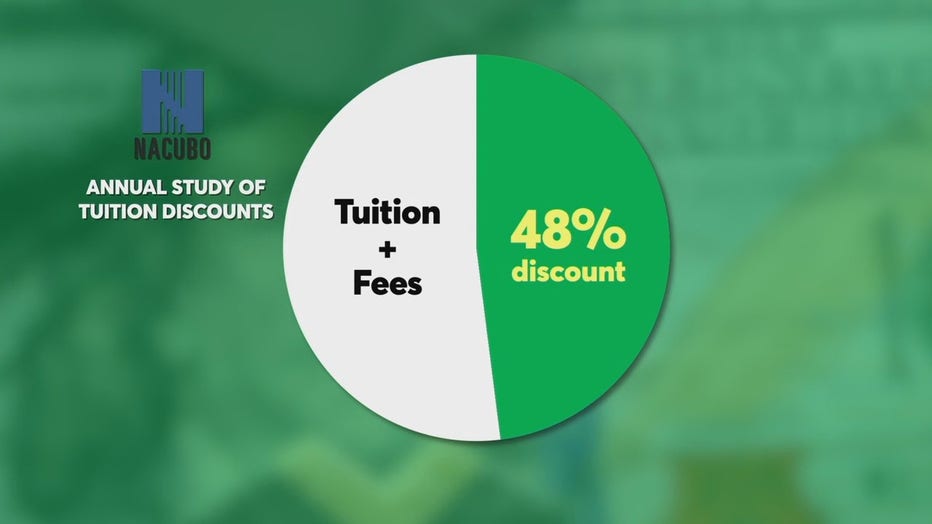

Many private schools whose enrollment was hurt by the pandemic are aggressively discounting tuition and fees to attract new students and retain current ones.

A study shows that on average, undergraduates got a record 48 percent discount on tuition and fees in the form of scholarships, grants, and fellowships in the 2020-21 school year from private

schools.

And Congress has given colleges a 36 billion dollar pot of money to distribute in emergency financial grants—money that doesn’t have to be paid back—to students hurt by the pandemic.

This aid will help keep people in school who are struggling financially and prevent them from going deeper into debt.

Eligibility varies by school, so you should check with your financial aid office to see how it works.

The pause on student loans was extended until the end of January.

Also, the American Rescue Plan signed into law in March includes a provision that makes all student loan forgiveness tax-free through 2025.

The Department of Education has also streamlined the process for people with a total or permanent disability to apply to have their loan discharged.

Talk with your loan servicer if you think you fall into one of these categories to make sure the new rules are being applied in your case.

All Consumer Reports material Copyright 2021 Consumer Reports, Inc. ALL RIGHTS RESERVED. Consumer Reports is a not-for-profit organization which accepts no advertising. It has no commercial relationship with any advertiser or sponsor on this site. Fo