Survey: 93% of student loan borrowers aren't ready to restart payments in May

Student loan payments resume in May, but a new survey suggests that the vast majority of borrowers aren't financially prepared. (iStock)

Federal student loan payments restart May 1 after more than two years of COVID-19 emergency forbearance. However, 93% of student loan borrowers are not ready to resume payments, according to a February survey conducted by the Student Debt Crisis Center (SDCC).

More than a quarter (27%) of the 23,532 student loan borrowers surveyed said they will never be financially prepared to make payments again. Additionally, 85% said that they currently depend on the financial relief from the payment pause.

If you're among the vast majority of student loan borrowers who are not ready to restart payments in two short months, keep reading to learn how you can financially prepare. One strategy is to refinance your student loans at a lower interest rate. You can visit Credible to compare student loan refinancing rates for free without impacting your credit score.

POLL: MOST AMERICANS WANT STUDENT LOAN PAYMENT PAUSE EXTENDED UNTIL 2023

Student loan borrowers say inflation will make it harder to resume payments

With inflation and consumer debt at all-time highs, the vast majority (92%) of fully employed student loan borrowers are concerned that rising prices will make it harder to afford their monthly payments in May, SDCC reports.

"Our findings show that the ongoing pandemic combined with unprecedented inflation are huge obstacles for borrowers who are, by and large, not ready to resume payments, struggling to afford basic needs, and confused about their options moving forward," said SDCC President Natalia Abrams.

Inflation has risen 9% since the coronavirus pandemic began in March 2020, according to the Consumer Price Index (CPI). So although your student loan payments may be the same as they were before the forbearance period, rising prices on other goods and services can make it more difficult to afford your monthly payments.

One way to reduce your student loan payments is to consolidate into a private loan at a lower interest rate. Keep in mind that refinancing your federal loans will make you ineligible for government benefits, such as income-driven repayment plans (IDR) and select student loan forgiveness programs. You can learn more about student loan refinancing on Credible to decide if this strategy is right for you.

THESE 2.4M BORROWERS MAY NOT GET STUDENT LOAN FORGIVENESS

How borrowers can prepare to resume student loan payments

A third of borrowers surveyed by SDCC said they've reduced spending on necessities like food, rent and healthcare in preparation for the end of forbearance in May. However, there are several other ways to prepare for student loan repayment:

- Get in touch with your loan servicer

- Enroll in income-driven repayment

- Apply for additional federal deferment

- Seek out student loan forgiveness

- Lower your monthly payments by refinancing

Learn about each strategy in the sections below.

Get in touch with your loan servicer

During the student loan payment pause period, millions of borrowers had their loan balances transferred to a new servicer. Of concern, more than half of borrowers surveyed say their student loan servicer has not contacted them with details about when their payments will resume.

Contact your loan servicer to get a clear idea of your payment due date, monthly payment amount, remaining loan balance and current interest rate. Your loan repayment terms should be the same as they were before the forbearance period began. However, you may need to re-enroll in auto-pay to avoid missing a payment in May.

If you're unhappy with your current repayment terms, such as your interest rate or monthly payments, you may consider refinancing. You can see your student loan refinancing offers on Credible for free with a soft credit inquiry.

3 STUDENT LOAN CHANGES IN 2022 THAT BORROWERS SHOULD KNOW ABOUT

Enroll in income-driven repayment

Federal student loan borrowers may be eligible to enroll in an IDR plan to limit their monthly payments to between 10% and 20% of their disposable income. The Department of Education offers four IDR plans, depending on the type of student loans you have:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

The amount you pay each month depends on the type of plan you choose, as well as your household income and family size. See if you're eligible for income-driven repayment by signing in to your account on the Federal Student Aid (FSA) website.

Apply for additional federal deferment

If IDR plans aren't enough to keep you out of delinquency, then you might consider deferring your federal student loans. It's important to note that interest may accrue on your loans while you're in deferment, which will add to the overall cost of borrowing.

You may be eligible to defer your federal student loans if you're unemployed or if you meet the standards for economic hardship. It's also possible to defer your student loan payments while you're still in school.

LAWMAKERS ESCALATE PRESSURE ON PRESIDENT JOE BIDEN TO CANCEL STUDENT LOANS

Seek out student loan forgiveness

As a presidential candidate, Joe Biden campaigned on canceling $10,000 worth of student loan debt per borrower. And while the president has not yet enacted widespread student loan forgiveness, his administration has delivered billions of dollars worth of student loan relief through the following programs:

- Public Service Loan Forgiveness program (PSLF): The Biden administration announced significant changes to the PSLF program in October 2021 that made it easier for applicants to meet the eligibility requirements. As a result, approximately 70,000 public servants have received $5 billion worth of student loan cancelation under this program.

- Closed school or borrower defense discharge program: If your college engaged in misconduct while you were enrolled or has since become default, then you may be eligible to have your federal student loan debt forgiven. The Education Department has canceled about $3.2 billion worth of debt through these programs since President Biden took office.

- Total and permanent disability discharge program (TPD): Borrowers with a disability may be able to have their federal student loans discharged. Under the Biden administration, more than 400,000 borrowers have qualified for TPD discharges for a total of $7 billion in student loan relief.

These federal student loan forgiveness programs have strict eligibility requirements, which means that many borrowers won't qualify. Plus, these programs only apply to federal student loan debt, not private student loans.

Lower your monthly payments by refinancing

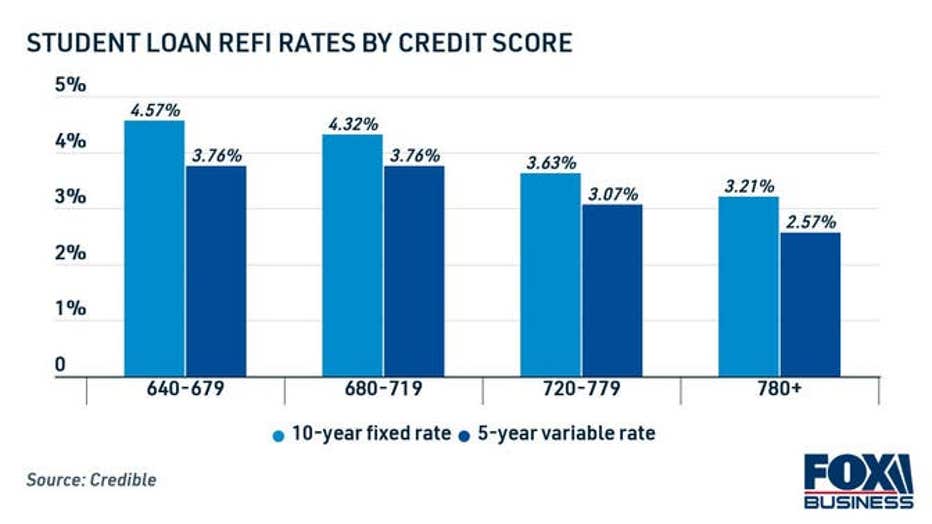

It may be possible to reduce your monthly payments, repay debt faster and save money over time by refinancing your student loans to a lower interest rate. Student loan refinance rates are currently near record lows, according to data from Credible, which means that some borrowers may be able to save more money than ever before.

The interest rate you qualify for depends on the loan amount and loan length, as well as your credit score. Well-qualified applicants with good credit scores will qualify for the best possible student loan refinancing offers. On the other hand, borrowers with bad credit may need to refinance their student loans with a cosigner to meet the eligibility requirements.

That being said, student loan refinancing isn't right for everyone. If you plan on taking advantage of federal student loan benefits, such as student loan forgiveness programs, then refinancing would make you ineligible. But if you don't plan on utilizing federal protections, or if you already have private student loan debt, then refinancing may be a good option.

You can compare student loan interest rates from private lenders in the table below. Then, you can use a Credible's student loan refinance calculator to decide if this strategy is right for your financial situation.

STUDENT LOAN FORBEARANCE EXTENSION: WHAT BORROWERS SHOULD KNOW

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.