Mortgage interest rates fall below 3% for first time in 2 weeks

Mortgage rates plummeted this week, dropping below the 3% mark once again. (iStock)

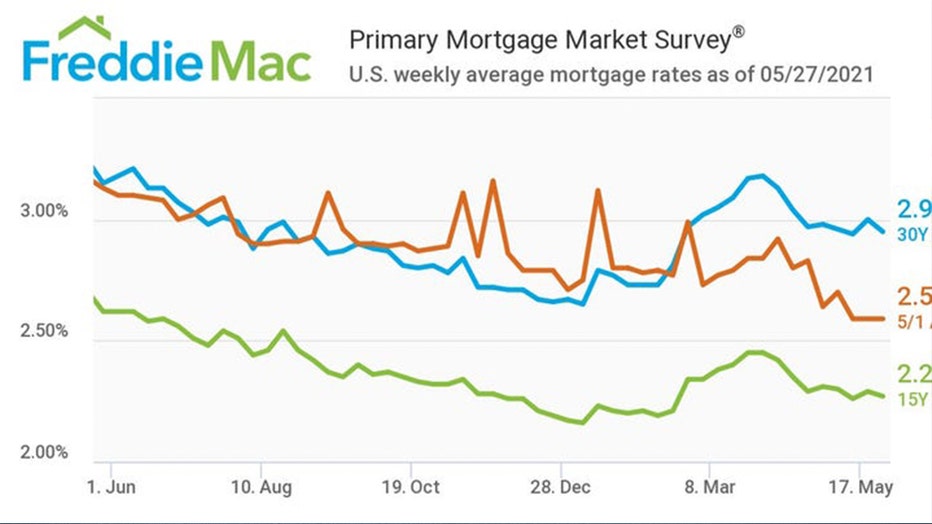

Average mortgage rates dropped 0.7 points from last week to 2.95% for a 30-year fixed-rate mortgage for the week ending May 27, 2021, according to Freddie Mac’s latest Primary Mortgage Market Survey.

"Mortgage rates are down below three percent, continuing to offer many homeowners the potential to refinance and increase their monthly cash flow," Freddie Mac Chief Economist Sam Khater said. "In fact, homeowners who refinanced their 30-year fixed-rate mortgage in 2020 saved more than $2,800 annually. Substantial opportunity continues to exist today, as nearly $2 trillion in conforming mortgages have the ability to refinance and reduce their interest rate by at least half a percentage point."

To see how much you could save by refinancing your mortgage, check out Credible’s online marketplace to find your rate without affecting your credit.

RISING HOME PRICES THREATEN TO OVERHEAT SUMMER HOUSING MARKET

Interest rates were down for 15-year mortgages, but held steady for adjustable mortgages:

- The 15-year fixed-rate mortgage (FRM) averaged 2.27%, down from last week when it averaged 2.29%. At this time last year, it averaged 2.62%.

- The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.59%, unchanged from last week. At this time last year, it averaged 3.13%.

The chart below shows the movement of mortgage rates over the past year. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Last week, the 30-year mortgage increased to over 3%, where the rate had been hovering since March. Visit an online marketplace like Credible to view your rate and compare mortgage lenders.

FEDERAL FUNDS RATE ABOUT TO RISE: WHEN AND HOW MORTGAGES, OTHER LOANS WILL BE IMPACTED

A trend toward rising rates comes as the U.S. is entering a time where mortgage rates could begin to destabilize, with moves depending on investors’ reactions to the latest economic data.

"Investors reacted to rising inflation and the release of minutes from the Federal Reserve’s last meeting, which pointed to a growing consensus that in the months ahead the central bank may have to consider tapering its purchases of Treasuries and mortgage-backed securities if the economy continues at the current pace," realtor.com Senior Economist George Ratiu said of last week’s mortgage rate increase. "We are moving into a seesawing period for mortgage rates, as investors react to monetary shifts in response to market performance."

HERE'S WHY MORTGAGE RATES ARE ON THE RISE

As economic factors strengthen, the Federal Reserve will begin to think more seriously about raising the federal funds rate, which would indirectly cause mortgage interest rates to rise.

To secure your mortgage rate at today’s historic lows, visit Credible to get in touch with experienced loan officers and get your mortgage questions answered.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column