Car theft surged in 2020, report finds: Why you need auto insurance that protects against theft

Auto theft surged in 2020 amid the coronavirus pandemic. Here's what you need to know about car insurance and how it covers vehicle theft. (iStock)

Unlocked cars are an easy target for enterprising thieves. Often, criminals will simply rummage through your vehicle to steal any valuables inside. Sometimes, though, they'll find a way to steal your car outright.

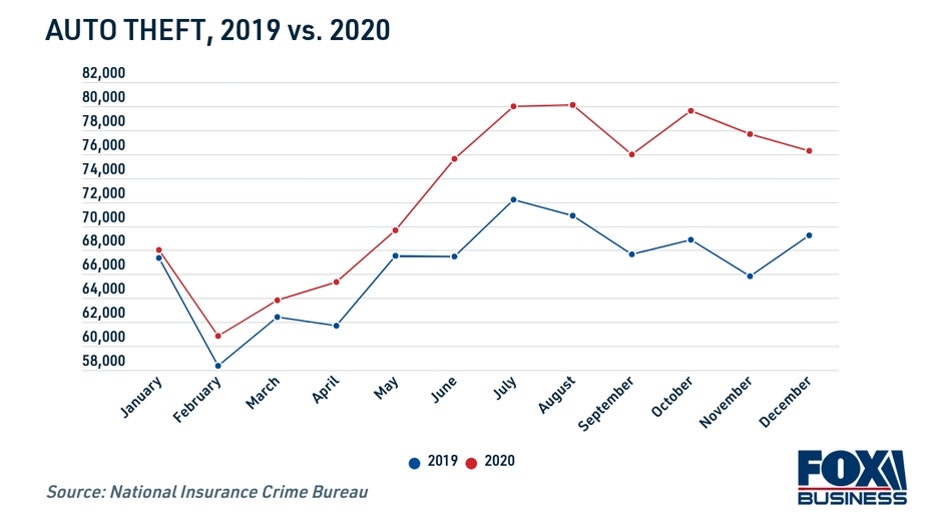

Nearly 873,080 automobiles were stolen in 2020, an increase of 9.2% from 2019, according to an analysis by the National Insurance Crime Bureau.

HOW TO KEEP YOUR CAR INSURANCE COSTS LOW AMID RATE INCREASES

Experts credit the increase in auto theft to societal unrest during the coronavirus pandemic. And with the COVID-19 Delta variant threatening to turn back the clock on America's recovery, it's possible that another uptick in vehicle theft is on the way.

"The pandemic has had significant impacts on society," said NICB President and CEO David Glawe in a news release. "We have a lot of disenfranchised youth that are unemployed, and outreach programs are shut down or limited due to COVID. There is frustration and anger in society. We are also seeing public safety resource limitations and withdrawal of proactive policing due to budget constraints. I’ve been studying this for almost 30 years; when you have a perfect storm like this, we see that manifest in crimes against automobiles."

No matter what's driving the surge in auto theft, one thing is for certain: now is the best time to make sure you're protected financially if your car is stolen. You can compare car insurance policies on Credible's online financial marketplace.

COMPARING CAR INSURANCE QUOTES CAN SAVE YOU HUNDREDS OF DOLLARS PER YEAR

How to know if your car insurance policy covers theft

After your house, your car is likely the second-most expensive thing you own. Auto insurance covers you financially in the event that your car incurs damage and needs repairs. But does insurance cover car theft? It depends on the type of coverage you have: comprehensive or liability.

Comprehensive car insurance covers theft, vandalism, natural disasters, falling branches and other damages done to your vehicle that are not the result of a collision. You'll just have to pay the deductible if your windows are smashed or your door locks are damaged — even if your car is stolen and you need a replacement. This type of coverage is usually optional, depending on where you live.

Liability insurance usually protects against property damage and bodily injury as the result of an accident, and it won't likely cover a stolen vehicle. Unlike comprehensive auto insurance, liability insurance is required by law in most states.

Get in touch with your car insurance company to ask about your coverage and see if you'd be covered against car thieves.

If you're shopping for auto insurance, it's important to compare coverage and quotes among multiple insurance companies to ensure you're getting the best possible rate for your situation. You can compare car insurance policies for free on Credible.

NEARLY 1 IN 5 AMERICANS HAS UNPAID MEDICAL BILLS, STUDY FINDS

What to do if your car is stolen

You're searching around the street where you parked your car, but all that's left is a pile of broken glass and tire marks. Take a deep breath and don't panic, because you need to act fast to ensure you'll be covered by your insurance provider.

Here's what to do if you're the victim of auto theft:

- File a police report. It's important that you provide the police with a detailed account within 24 hours of the crime taking place. You'll need to know your vehicle identification number (VIN) and license plate number, as well as any personal belongings that were in the car at the time of the theft.

- Get in touch with your insurance company. They may have a waiting period to see if your vehicle is recovered before taking action. If your car is recovered after being stolen, get it inspected right away. Criminals often steal cars to strip it of necessary parts, so an inspection will make sure it's safe to drive.

- Contact your auto insurance lender. Unless you own your car outright, you'll need to get in touch with your auto loan lender or the lease provider, since they will receive the settlement if your car isn't recovered.

- File an insurance claim. If you're protected with comprehensive coverage, your insurer will reimburse you for the actual cash value (ACV) of your stolen car.

Comprehensive insurance provides peace of mind, and it's more important than ever to have sufficient protection with auto theft on the rise. You can find auto insurance that protects against theft by shopping around on Credible's online marketplace.

HOW TO BUY HOMEOWNERS INSURANCE

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.